circular economy business

Environmental, Social, and Governance ESG Investment Blueprint

Dinis GuardaAuthor

Banking,Investment,Sustainability

Fri Feb 14 2025

Environmental, Social and Corporate Governance (ESG) investment is a critical term that is often used synonymously with modern sustainable investing. This type of investment is based on three central factors to measure the sustainability and ethical impact of an investment in a company or business. In a world struggling with structural challenges, ESGs investment can actually make a difference for good in the funding and investment industry worldwide.

According to MSCI ESG Research, ESG investment is the consideration of environmental, social and governance factors alongside financial factors in the investment decision-making process. ESG investments are a set of standards that companies and investors need to follow when being involved in a potential investment operation. These are based on various criteria like Environmental criteria, social criteria and governance.This means organisations, banks and businesses are socially responsible investing, mission-related investing, or screening to create meaningful ways.

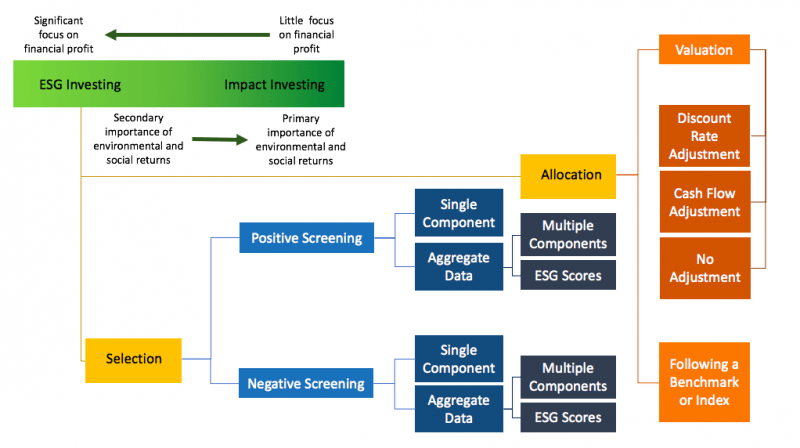

Under the ESG investing umbrella, there are three common investor objectives or motivations when considering an ESG strategy: Integration, Values and Impact. In order to achieve these objectives, institutional investors may pursue different approaches such as ESG integration, exclusionary or negative screening, or thematic investing, to name a few.

The World Bank, OECD and ESG

The OECD and World Bank estimate that USD 6.9 trillion investment a year is required up to 2030 to meet climate and development objectives. As of today, current spending on infrastructure is only around USD 3.4 – 4.4 trillion, which significantly lags behind the needed spending.

Governments and special cities have a large role to play in filling this gap, but they are often fiscally constrained and overwhelmed by societal challenges such as ageing populations, health and education. This development comes with no surprise – the UN estimates that by 2050, c.70% of the world’s population will live in urban areas. This means new opportunities for governments, communities and businesses alike, especially when it comes to smart technologies. However, at the same time, we are facing enormous infrastructure challenges.

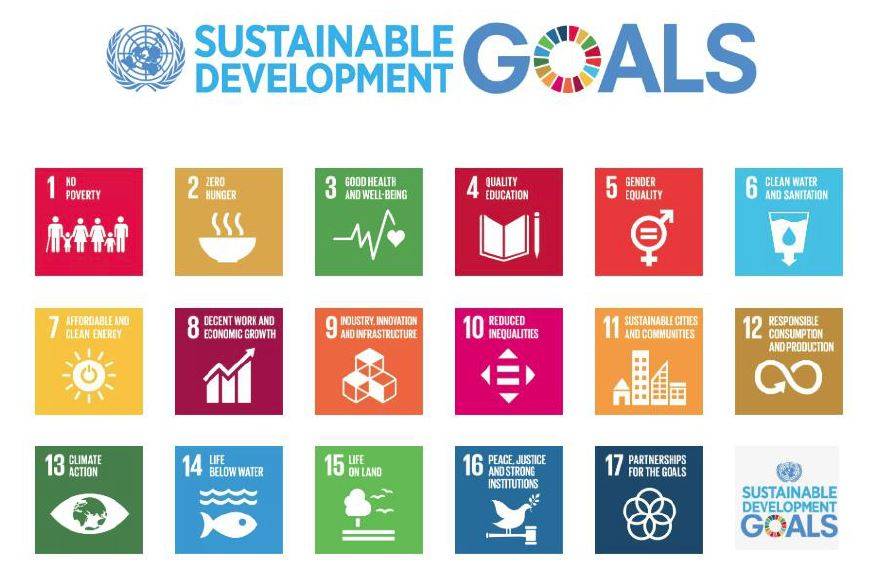

That is why the UN added Sustainable and Renewable communities into the Sustainable Development Agenda 2030 (SDG Goal 11). And as the World Bank pointed out, Environmental, Social and Corporate Governance (ESG) investment can play a key role to meet these climate and development objectives.

In fact, the World Bank is leading research on this subject. The institution offers an ESG Data Draft dataset that provides information on 17 key sustainability themes spanning environmental, social, and governance categories. This implies that shifting financial flows is needed if we are to be better aligned with global goals. The World Bank Group (WBG) is working to provide financial markets with improved data and analytics that shed light on countries’ sustainability performance and helps investors make better decisions to create more credibility and transparency on business and investments. Along with new information, data research and digital tools, the World Bank is also developing additional research on the correlation between countries’ and cities sustainability performance and the risk and return profiles of relevant investments and funding.

Institutional investors already invest in infrastructure projects, with USD 2.5 trillion currently privately invested. However, investment channels, private-public partnerships and investments at scale must be aligned with the SDGs to meet longevity and sustainability goals, while building infrastructure for smart cities projects remains a key challenge.

More About Sustainability

Post-Covid Ecological Remediation

How Businesses Can Contribute To A More Sustainable World Post-COVID-19

Paulig sets new strategic sustainability targets for 2030 to drive the sustainable future of food

Earth day and Political Pollution: Why politicians need to reduce their carbon footprint

What Main Criteria make up the Environmental, Social, and Governance (ESG) factors?

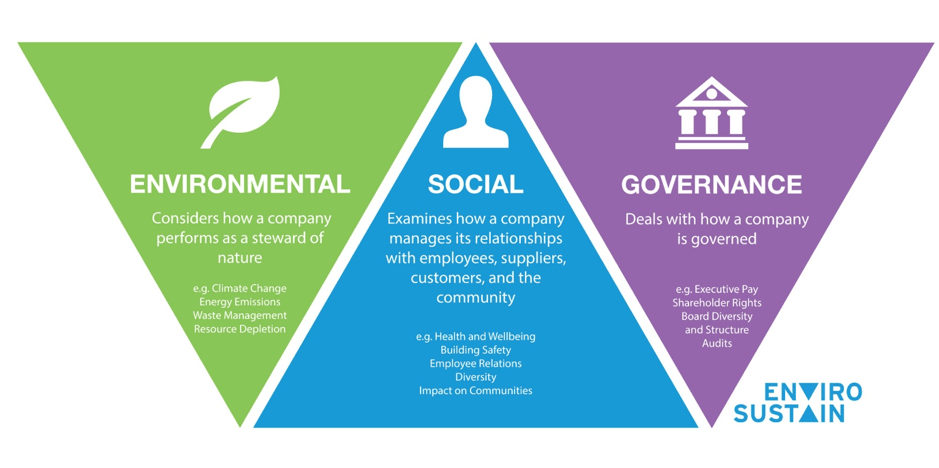

Environmental, social and governance (ESG) criteria are a set of principles and standards that investors need to follow if those operations are to enter the ESG spectrum. Environmental criteria measure how a company performs as a steward of the environment. Social criteria look at how the company manages its relationships with employees, suppliers, customers, and the communities where it operates. Governance deals with a company’s leadership, executive pay, audits, internal controls, and the rights of shareholders including employees.

These environmental, social, and governance (ESG) criteria are an increasingly adoptive way for investors to evaluate the companies in which they might want to invest.

Why do many financial investment organisations such as mutual funds, collective investments schemes, pension funds, brokerage firms, and robo-advisors now offer products that employ these ESG criteria?

ESG criteria can also help investors avoid companies that might pose a greater financial risk due to their unethical environmental or other practices.

Over the last few years, a new generation of investors are now emerging, where they have shown interest in investing their money where their ESG values are aligned with brokerage firms, unit trusts and mutual fund companies whom have begun to offer instruments like exchange-traded funds (ETFs) and other financial products that follow these ESG criteria. According to the most recent report from US SIF Foundation, investors held $11.6 trillion in assets chosen according to ESG criteria at the beginning of 2018, up from $8.1 trillion just two years ago.

How the Environmental, Social, and Governance (ESG) Factors work and will be increasingly more important?

In order to assess a company based on these environmental, social, and governance (ESG) criteria, investors examine a broad range of information regarding these ESG criteria.

These criteria, agreed internationally, help investors find companies with values that match their own. For example, the environmental criteria may include a company’s energy use, waste management, pollution, carbon footprint, natural resource utilisation and conservation, as well as their treatment of animals in their supply chain.

Social criteria look at the company’s business relationships. Some of the questions that investors can do to see if an investment is compliant with the social criteria are :Does it work with suppliers that hold the same values as it claims to hold? Does the company donate a percentage of its profits to the local community or encourage employees to perform volunteer work there? Do the company’s working conditions have respect for its employees’ health and safety? Are other stakeholders’ interests taken into account?

Lastly, investors may want to know that a company uses accurate and transparent accounting methods and that stockholders are given an opportunity to vote on important issues. These are related to the governance criteria. They may also want assurances that companies avoid conflicts of interest in their choice of board members, don’t use political contributions to obtain unduly favorable treatment and, of course, don’t engage in illegal practices.

ESG criteria are quite strict and thorough, and as such, complications may arise. Fundamentally because no single company may pass or excel in every test for all categories. At this point, investors need to decide what’s most important to them according to their own set of values. On a practical level, investment firms that follow ESG criteria must also set priorities. One excellent example would be that of Unilever and its Project Sunlight. The payoffs are real when Unilever developed Sunlight back in 2013, a brand of dishwashing liquid that used much less water than its other brands, sales of Sunlight and Unilever’s other water-saving products proceeded to outpace category growth by more than 20 percent in a number of water-scarce markets. And Finland’s Neste, founded as a traditional petroleum-refining company more than 70 years ago, now generates more than two-thirds of its profits from renewable fuels and sustainability-related products.

These criteria are also good standards to automatically discard investing in companies with major recent or ongoing controversies related to workplace discrimination, corporate governance, and animal welfare, among other issues.

Pros and Cons of Environmental, Social, and Governance (ESG) Criteria and how to look at it

In years past, socially responsible investments had a reputation for requiring a tradeoff on the investor’s part. Because they limited the universe of companies that were eligible for investment, they also limited the investor’s potential profit. This created a legacy system whereas “Bad” companies sometimes performed very well, at least in terms of their stock price, while conscious and sustainable companies struggled to find investment for their ideas.

More recently, however, some investors have come to believe that environmental, social, and governance criteria have a practical purpose beyond any ethical concerns. By following ESG criteria they may be able to avoid companies whose practices could signal a risk factor— this year between February 19 and March 26, the S&P 500 index fell by 26.9pc. During the same period the companies rated most highly on ESG characteristics fell by 23.1pc. Those rated worst fell much more than the market as a whole (down 34.3pc) while the companies in between traced a straight-line correlation. The middle three rankings fell by 25.7pc, 27.7pc and 30.7pc respectively.

As ESG-minded business practices gain more traction, investment firms are increasingly tracking their performance. Financial services companies such as JPMorgan Chase, Wells Fargo, and Goldman Sachs have published annual reports that extensively review their ESG approaches and the bottom-line results. Recent empirical research has shown that considering sustainability factors within investment practices does not come at a cost (i.e. through a reduced opportunity set) but allows for competitive returns. Furthermore, the growing market and resulting competition in the wake of sustainable investing going mainstream has the welcome effect of compressing fees for such products. Hence, staying informed about recent trends in sustainable investing is imperative no matter what the main motivation is.

Share this

Dinis Guarda

Author

Dinis Guarda is an author, entrepreneur, founder CEO of ztudium, Businessabc, citiesabc.com and Wisdomia.ai. Dinis is an AI leader, researcher and creator who has been building proprietary solutions based on technologies like digital twins, 3D, spatial computing, AR/VR/MR. Dinis is also an author of multiple books, including "4IR AI Blockchain Fintech IoT Reinventing a Nation" and others. Dinis has been collaborating with the likes of UN / UNITAR, UNESCO, European Space Agency, IBM, Siemens, Mastercard, and governments like USAID, and Malaysia Government to mention a few. He has been a guest lecturer at business schools such as Copenhagen Business School. Dinis is ranked as one of the most influential people and thought leaders in Thinkers360 / Rise Global’s The Artificial Intelligence Power 100, Top 10 Thought leaders in AI, smart cities, metaverse, blockchain, fintech.

More Articles

Exploring the Dallas Map with Cities: Your Ultimate Guide to the Metroplex

Exploring the Largest Cities in US Population: A Comprehensive Guide for 2025

Exploring the Big Cities in the US: A Comprehensive Guide to America's Urban Giants

Exploring US Cities on Map: A Comprehensive Guide to America's Urban Landscape

Exploring Australian Capital Cities: A Comprehensive Guide to Each City